Benefits of Using an Online Home Loan Affordability Calculator Before Availing a Home Loan in India

Every individual would like to have a place of their own someday. However, buying a house in today’s times is quite the challenge, with property prices being so high. The good thing is that financial institutions offer various home loan plans to homebuyers, thus providing the required financial assistance. Before you apply for a home loan, it is essential to ensure the loan can quickly be paid off. Those who do not plan to repay their loan beforehand can face financial problems in the future when clearing the monthly installments of their home loan. This could negatively affect their credit scores and even land them in legal trouble with the lender.

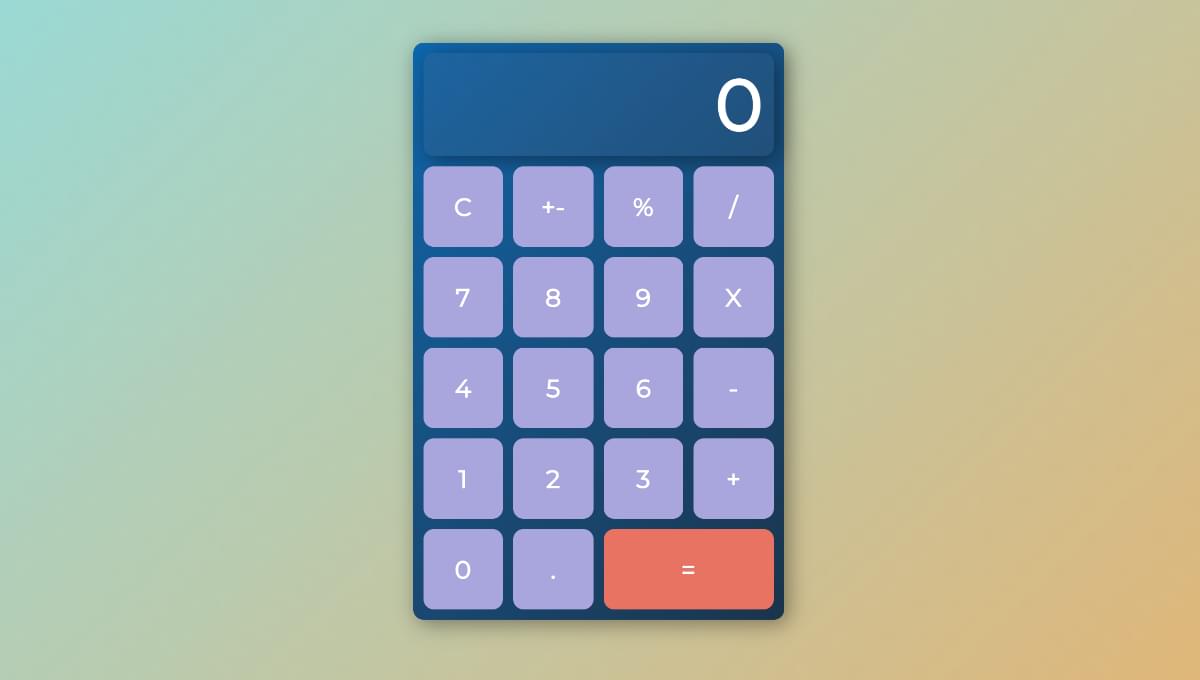

To avoid all these problems, it is advisable to use a home loan affordability calculator. This calculator is an online tool that will help you find a loan plan that matches your budget. This calculator allows the borrower to clear their home loan without facing any unnecessary hassles at repayment.

If this is the first time you are reading about a home loan affordability calculator, learn about the following benefits of using one:

1. A home loan affordability calculator helps in finding a convenient repayment tenure

Picking a suitable repayment tenure is essential for comfortably paying off the loan’s monthly installments. A home loan affordability calculator lets users input different tenure values to find one convenient for their budget.

2. This calculator is straightforward to operate

Manually calculating a home loan’s affordability can be challenging and time-consuming. On the other hand, a home loan affordability calculator makes this process really easy. The calculator needs details regarding the borrower’s monthly income, existing debt, down payment for the property, home loan interest rate, and repayment tenure. After getting these details, the calculator will display the amount one can apply for.

3. It provides accurate results immediately

Manual calculations do not just take time, but they are also prone to errors. A home loan affordability calculator provides accurreallts that can be relied on. Also, once the calculator has the information it needs, it provides results immediately. This way, you can find out which loan plan is affordable without wasting any time.

After reading about the benefits of a home loan affordability calculator, it becomes apparent why using one is so important. After using this calculator and finding out about the loan amount you can afford, make sure to also check with the lender about their home loan eligibility criteria. Every lender can have terms regarding a borrower’s eligibility criteria for a home loan. Awareness of all these things before applying for a loan reduces the chances of your loan application getting rejected.